Take A Break From Your Loan Payment!

There are times when you may need a little extra cash due to unexpected financial obligations. Our Skip-A-Pay program lets members skip one monthly payment on eligible loan(s) each calendar to free up some cash for times when your budget is a little tight.

To skip your payment(s) the following criteria needs to be met:

- You must be the Primary Member on the loan.

- You must be in good standing with the credit union.

- The loan must not be a credit card, real estate loan, line of credit, cash please loan, first cash overdraft line of credit, promotional loan, workout loan or government shutdown loan.

- The loan must not have force placed insurance.

- The next payment due date on the loan cannot be more than 29 days in the past.

- The loan must have at least 6 months of payment history.

- A skip payment can be performed once every 12-month period on a given loan.

- There is a max of 6 skip payments per the life of the loan.

- Loan cannot have any prior extensions processed.

Please note:

- There is a fee of $20 for each skip payment request.

- For weekly, bi-weekly, or semi-monthly payments, the loan will be advanced 4 weeks.

- If your payment is set up as an electronic payment from another Financial Institution, it is your responsibility to cancel the upcoming payments with your other Financial Institution.

Skip-A-Pay when it's right for you!

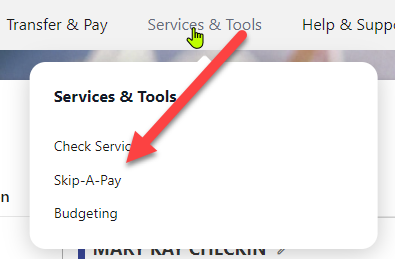

Just login to Online Banking or through the Mobile App to see if you have eligible loans to skip. If you have a loan that is eligible for Skip-A-Pay you will see the option available within your Online & Mobile Banking as shown below.

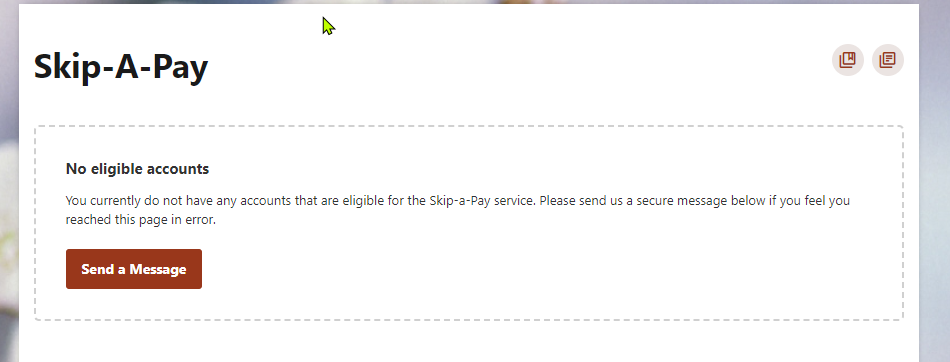

If you do not have any loans available for Skip-A-Pay you will see the below.